If you’re billing international customers, be sure that all of the currency conversions add up. If you’ve added anything that hasn’t already been discussed with the customer, be sure to specify why it’s included.

There should be no surprise fees included on your final invoice.

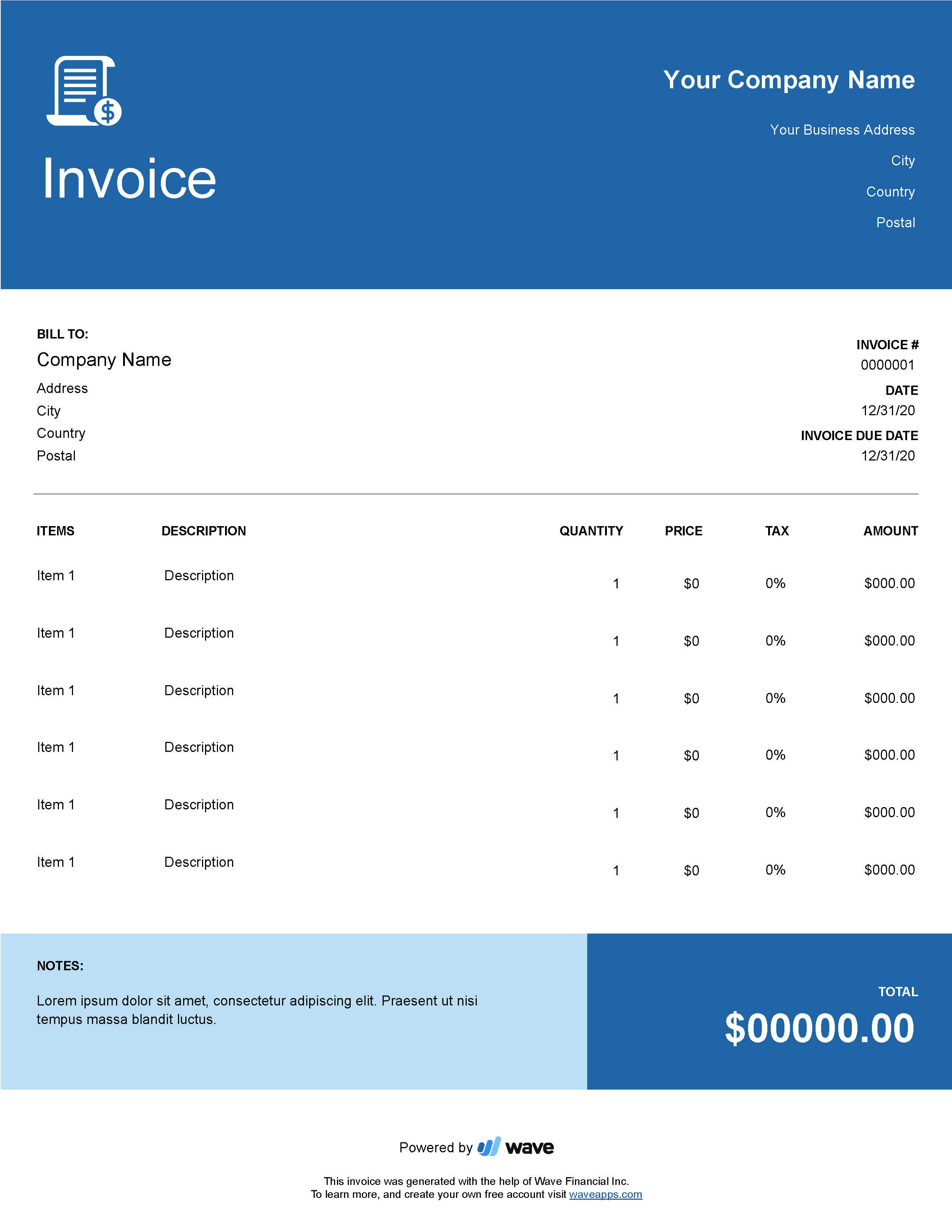

CREATE AN INVOICER PDF

Simply fill in your business details in the invoice template to populate the statement, customize the color and logo to fit your brand, and download it as a PDF to be sent off to your customers.

CREATE AN INVOICER GENERATOR

Sounds like a lot to remember? There are a number of free invoicing tools that you can lean on to ensure you’re not leaving any important information off of your invoices.įor example, our free Invoice Template Generator aims to simplify the process by allowing you to easily create and download professional invoices to send to your customers.

3) Debt collection policies.Įven when you have an organized process for invoicing, having to deal with non-paying customers is still a reality to plan for. By meeting your customers where they are, you make it easier for them to complete payments on time, every time.ĭifferent payment methods might include: Credit/debit card payments, cash, check, money order, and so on.

These methods should also reflect your customer’s payment preferences. Your approved payment methods play an important role in facilitating hassle-free invoicing and should aim to reflect your unique business needs and privacy commitments. Payment methods refer to the channels through which your customers can pay for your products or services. The key word here is schedule: You want to pick a payment plan and stick to it to avoid confusion, set clear expectations, and streamline cash flow. To create clear payment terms for your invoice, you need to figure out: 1) When you want to get paid.ĭepending on the product or service you offer, as well as your own unique business needs, you can choose to invoice weekly, monthly, quarterly, or set a custom schedule. To do this effectively, you need to start by looking inward and defining the payment terms that make the most sense for your business.

Invoicing Payment TermsĪs an SMB, you’ve got you own set of expenses to cover, which means it’s super important that you have a clear plan for bringing money back in to your business. To help you get started, we’ve outlined the basics for setting up an organized invoicing process for your business below. It requires some strategic thought, a handful of decisions that could impact your business long-term, and a bit of alignment. Like most things worth doing, creating an invoicing process isn't the easiest task to accomplish. And in most organizations, disorganized invoicing can be a serious time suck. Unfortunately, that's not always how the story goes.

0 kommentar(er)

0 kommentar(er)